Calculate her net pay for two weeks. Mathematics concepts and skills in buying and selling computing gross and net earnings overtime and business.

Payroll In Excel How To Create Payroll In Excel With Steps

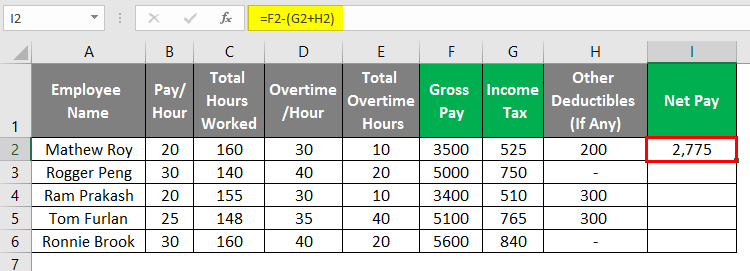

Net pay is the amount people receive after taxes and other deductions are taken out of gross pay.

. Adding the price of the laptop 740 and the sales tax 37 results in the total cost of 777. The overtime pay rate is 1½ times the regular rate of pay. Gross pay includes regular hours times regular pay plus overtime hours times overtime pay.

Financial knowledge and decision-making skills Grade level. BUILDING BLOCKS TEACHER GUIDE. EXERCISE 2-5 Building Math Skills.

To calculate gross margin return on investment you can use the following formula. Gross income is the sum of all incomes received from providing services to clients before deductions taxes and other expenses. 675 X 32 21600.

To calculate your net pay subtract 700 your deductions from. Up to 24 cash back Numbers 34 Develop number concepts and critical thinking skills. Deductionsboth required and voluntaryare subtracted from gross pay to compute.

Complete the following problems. EXERCISE 1-3 Building Math Skills. While sales tax is added to the starting amount of a purchase.

Money Math - COPIAN CDÉACF. They study hourly wages overtime pay weekly time cards and piecework pay as well as salary and commission. Use the example of a 740 laptop computer in a state with 5 sales tax.

H calculate the various earnings as affected by the laws related to minimum wage. For example if the employees annual pay is 12000 and there are 24 pay periods in a year their gross pay per period is 500. Subtract total cost of goods sold from net sales to calculate blended gross profit.

Brick Undergrounds Gross Rent Calculator enables you to easily calculate your gross rent make quick apples-to-apples comparisons between apartments and avoid expensive surprises. She makes 925 an hour and works 32 hours a week. Max earns 750 per month.

To create a realistic budget and ensure you have enough money to cover your necessary monthly expenses its helpful to base your monthly budget on. Applies mathematical skills to complete tasks as necessary. The total weight of a shipment which includes the weight of the container and the items within.

Review information on how to read a pay stub and answer questions about earnings and deductions. Applied Math Business Other Math Grades. Net pay gross pay - deductions.

Compute his yearly salary. Gross income is the revenue a business receives minus COGS. You determine that your monthly deductions amount to 700.

This is a workbook I created to teach my special education students about net and gross pay. For a company net income is calculated by subtracting all the business. He worked 32 hours last week.

Net and Gross Pay Workbook- 4 Worksheets by. Monthly you make a gross pay of about 2083. Compute his weekly pay.

All youll need to figure out. On the second worksheet the students are given the wage and the deductions in percentages and. To compute the gross pay of employees with an annual rate divide the total amount of yearly pay by the number of pay periods within a year.

Calculate tax withholdings deductions and the difference between gross income and net income. This amount is considered your gross pay. Income tax is a tax on the amount of income people earn.

Investigating payroll tax and federal income tax withholding. Sams rate of pay is 675 per hour. People pay a percentage of their income in taxes.

High school 912 Age range. GMROI gross margin average inventory cost. Explain that one tax people pay is federal income tax.

Tare weight Net weight Gross weight. Her deductions are 25 to be subtracted from gross earnings. Lets say your yearly salary is 25000.

Demonstrate an understanding of income. View PF Ch 2 Computing Gross. Computing Gross and Net Pay Directions.

Gross Weight - Tare Weight Net Weight. If youve been talking about paychecks in your class this worksheet is a good practice. For example if net sales are 300000 and the cost of goods sold is 100000 the blended gross profit from all sources is 200000.

Jim makes 800 per month. Calculate the difference between gross income and net income. EXERCISE 2-3 I Building Math Skills.

If we go back to our vending machine example the gross income on your purchase of a drink is 50 150 -. Use the following formula to calculate your net pay. Net income is gross income minus all the taxes and other deductions.

Unit 1 - Wages Students begin the Business Math course learning about different ways that wages are handled. 800 X 12 9600 per year. Guidelines in Paying Overtime.

First show how 5 is converted to the decimal 05 and multiplied by 740 to arrive at a sales tax of 37. Math 10-3 Course Planning. Turnover net sales average retail stock.

It includes a review of the fundamental mathematics operations using decimals fractions percent ratio and proportion. Understand what types of taxes are deducted from a paycheck. This is what is known as take-home pay.

93 The hourly employees in your department worked a total of 7350 hours this week. Students analyze W-4 forms and pay stubs in order to better understand payroll taxes and federal income tax withholding. On the other hand net income is the profit attributable to a business or individual after subtracting all expenses.

The net effective rent is less than the amount you will actually have to pay --- known as your gross rent --- during your non-free months. To convert blended gross profit into blended gross profit margin divide blended gross profit by net sales. On the first worksheet students are given the deductions in dollar amounts.

Students will need to calculate gross income Social Security Medicare total deductions and Net Pay. Computing Gross and Net Pay Directions. His monthly job hours are 80.

Solve problems that involve unit pricing currency exchange and proportional reasoning. G compare and contrast between independent contractor earnings and employee earnings including tax requirements tax forms W-2 W-4 1099 and Form 941 and benefit requirements. Complete the following problems.

This formula allows a company to see how many times a retailer sells and replaces its inventory. F calculate net pay. Unit 2 - Taxes and Budgeting In this unit students investigate various taxes including state and federal.

To calculate inventory turnover use this formula. Gross pay is the amount people earn per pay period before any deductions or taxes are paid. Net Pay from FINANCE Personal F at Rolla Sr.

Other pay or benefits should be added. What students will do. It includes 5 sample paystubs.

Pf Ch 1 1 Choices That Affect Income Name Wm Cha Ter Choices That Affect Income Exercise 1 1 I Review Of Chapter Terms Directions Write The Letter Of Course Hero

Pf Ch 1 1 Choices That Affect Income Name Wm Cha Ter Choices That Affect Income Exercise 1 1 I Review Of Chapter Terms Directions Write The Letter Of Course Hero

Pf Ch 1 1 Choices That Affect Income Name Wm Cha Ter Choices That Affect Income Exercise 1 1 I Review Of Chapter Terms Directions Write The Letter Of Course Hero

0 Comments